Finance Minister: VAT not to be raised, property tax meant to deter corruption

Minister of Finance Đinh Tiến Dũng said the ministry would not raise VAT tax to 11-12 per cent, adjust environmental tax, and assured the public that the “proposed property tax is meant to prevent corruption, State budget collection is important but not the primary purpose [of the proposal.]”

Minister of Finance Đinh Tiến Dũng delivered a report on restructuring State budget collection-expenditure and financial discipline to the National Assembly on May 26. —

The statements were made as he was reporting to the National Assembly today morning on the progress of restructuring State budget collection-expenditure and financial discipline in recent times, as part of the ongoing 5th plenary meeting of the legislative body.

The head of the finance ministry said in the coming time, the ministry would continue integrating public and expert feedback on several tax codes.

Specifically, the ministry would keep value-added tax at 10 per cent instead of going up to 11-12 per cent as per a recent proposal; restructuring its list of untaxed goods or goods subject to 0%, 5% to maintain ‘fairness’; and especially no integration of social security policies in its tax codes to “prevent undermining of the independence of the tax structure.”

Minister Dũng asserted that the Government is implementing ‘synchronous measures’ to restructure the State budget and public debt towards a more ‘sustainable model.’

Specifically, State budget revenues in the two years 2016-17 all reached higher than original estimates – 9.3 per cent and 6.3 per cent, respectively.

Tax collection and fee collection, equal to 21.3 per cent of national GDP, has “helped to achieve expenditure goals.”

The Government, however, has been active in efforts to cut tax, for example, corporate income tax has been reduced from 23 per cent to 20 per cent in 2016, finance minister said.

Dũng admitted that the contribution of central budget in State budget has been on a downward trend lately – from the average of 61.3 per cent in previous years down to 56-57 per cent in 2016-17 period – due to decreased revenues from oil and import-export activities.

On State expenditure, the finance minister claimed the Government has tightened control on spending and debt ‘within the economy’s capacity.’ Spending on development has actually exceeded the target of 25-26 per cent by two percentage points.

Regular expenditure in 2016-17 hovers around 62-63 per cent and is set to reach 61.7 per cent in 2018, while keeping true to the Government’s goal of raising basic salary (for public employees) by 7 per cent a year.

Financial disciplines

Finance minister said that untruthful tax declaration, trade fraud, pricing transfer, tax evasion are still ‘common issues,’ due to tax payers’ low legal awareness and loopholes in the legal framework.

The Government has been pushing for self-declaration and electronic tax declaration, which reduce interaction between customs and tax officials and businesses. This change in management method is in line with international practice, helps to improve investment climate in the country, but it also presents legal loopholes that could be exploited, finance minister Dũng, adding that “[going online] is a step in the right direction but its weaknesses must be fixed.”

The finance ministry is also preparing a proposal in which it would ask National Assembly to let the ministry to erase uncollectable tax debts – as high as VNĐ31.5 trillion (US$1.4 billion) – to better reflect the actual tax debt and tax transparency.

Regarding the ‘rampant’ over-spending and wastefulness in several projects, the finance ministry said the causes are due to outdated regulations and low awareness on the part of organisations and individuals regarding State budget management, at both central and local levels, leading to corruption and misappropriation of State money.

VNS

The statements were made as he was reporting to the National Assembly today morning on the progress of restructuring State budget collection-expenditure and financial discipline in recent times, as part of the ongoing 5th plenary meeting of the legislative body.

The head of the finance ministry said in the coming time, the ministry would continue integrating public and expert feedback on several tax codes.

Specifically, the ministry would keep value-added tax at 10 per cent instead of going up to 11-12 per cent as per a recent proposal; restructuring its list of untaxed goods or goods subject to 0%, 5% to maintain ‘fairness’; and especially no integration of social security policies in its tax codes to “prevent undermining of the independence of the tax structure.”

Minister Dũng asserted that the Government is implementing ‘synchronous measures’ to restructure the State budget and public debt towards a more ‘sustainable model.’

Specifically, State budget revenues in the two years 2016-17 all reached higher than original estimates – 9.3 per cent and 6.3 per cent, respectively.

Tax collection and fee collection, equal to 21.3 per cent of national GDP, has “helped to achieve expenditure goals.”

The Government, however, has been active in efforts to cut tax, for example, corporate income tax has been reduced from 23 per cent to 20 per cent in 2016, finance minister said.

Dũng admitted that the contribution of central budget in State budget has been on a downward trend lately – from the average of 61.3 per cent in previous years down to 56-57 per cent in 2016-17 period – due to decreased revenues from oil and import-export activities.

On State expenditure, the finance minister claimed the Government has tightened control on spending and debt ‘within the economy’s capacity.’ Spending on development has actually exceeded the target of 25-26 per cent by two percentage points.

Regular expenditure in 2016-17 hovers around 62-63 per cent and is set to reach 61.7 per cent in 2018, while keeping true to the Government’s goal of raising basic salary (for public employees) by 7 per cent a year.

Financial disciplines

Finance minister said that untruthful tax declaration, trade fraud, pricing transfer, tax evasion are still ‘common issues,’ due to tax payers’ low legal awareness and loopholes in the legal framework.

The Government has been pushing for self-declaration and electronic tax declaration, which reduce interaction between customs and tax officials and businesses. This change in management method is in line with international practice, helps to improve investment climate in the country, but it also presents legal loopholes that could be exploited, finance minister Dũng, adding that “[going online] is a step in the right direction but its weaknesses must be fixed.”

The finance ministry is also preparing a proposal in which it would ask National Assembly to let the ministry to erase uncollectable tax debts – as high as VNĐ31.5 trillion (US$1.4 billion) – to better reflect the actual tax debt and tax transparency.

Regarding the ‘rampant’ over-spending and wastefulness in several projects, the finance ministry said the causes are due to outdated regulations and low awareness on the part of organisations and individuals regarding State budget management, at both central and local levels, leading to corruption and misappropriation of State money.

VNS

Đăng Ký

Share this:

Related Posts

Inter Phuc Quoc: InterContinental® Phu Quoc Long Beach Resort is opening today

6/21/2018 10:24:52 AM

Mining collapse: CEO absconds as another cryptocurrency firm implodes in Vietnam

7/30/2018 11:30:05 AM

Dr Philipp Rosler : VinaCapital Ventures names Việt Nam-born former German vice chancellor advisory board chairman

3/16/2019 9:22:43 AM

Radisson Blu Resort Phu Quoc in co-operation with Lavie to launch environment project

9/25/2020 2:53:16 PM

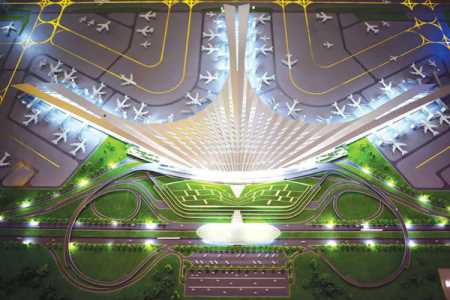

Long Thanh Airport: Construction of country’s largest airport starts in Đồng Nai Province

1/6/2021 7:51:42 AM

HCM City sets up mobile teams for COVID-19 testing at home, tightens travel from nearby provinces

7/11/2021 10:18:12 AM

HCMC to allow vaccinated people, recovered patients on the streets after September 30

10/1/2021 11:00:44 AM

Ministry of Health publicises prices of Molnupiravir drugs produced in Vietnam

2/24/2022 11:28:46 AM

Luxury aviation: Sun Air signed as sales representative for Gulfstream business aircraft in Viet Nam

3/27/2022 8:56:00 AM

Leave a Reply

Fan Page2

Top Views

Video

12/1/2015 10:32:36 AM

Welcome to Vietnam

Video

12/27/2015 12:11:22 PM

"Sa Pa Is Awesome"

VIETNAM BUSINESS & EVENT

5/4/2018 9:27:41 PM

CO-HOST SBG Raffle Night Blockchain and Cryptocurrency

VIETNAM BUSINESS & EVENT

5/4/2018 9:30:22 PM

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)